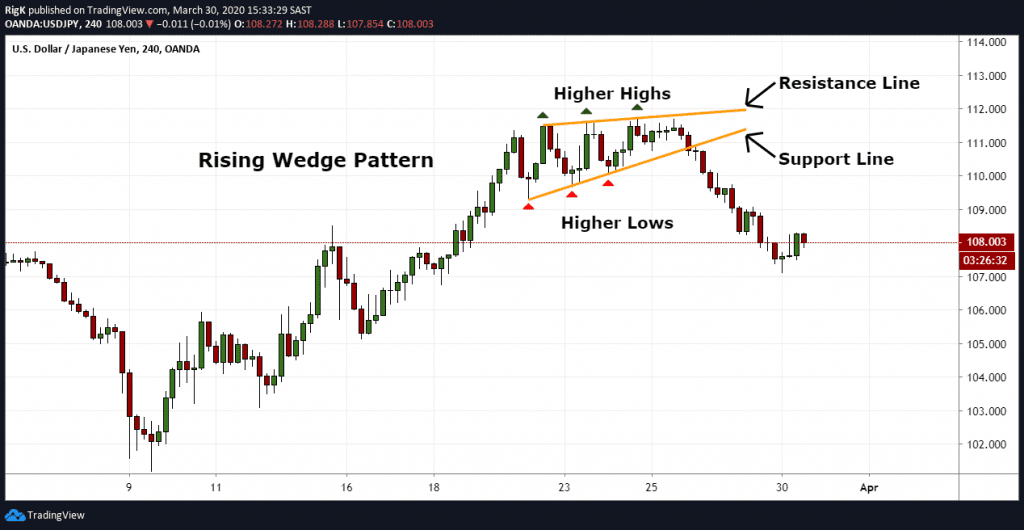

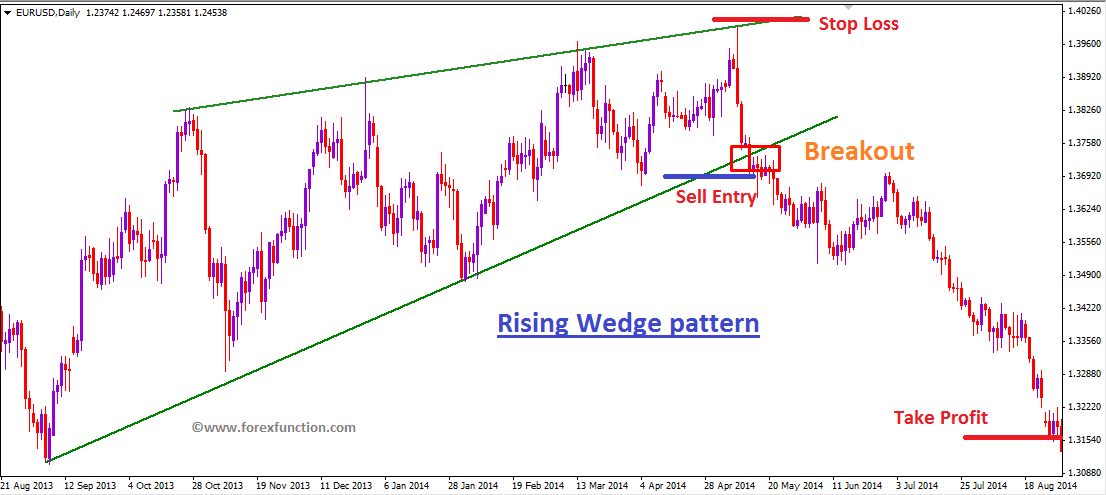

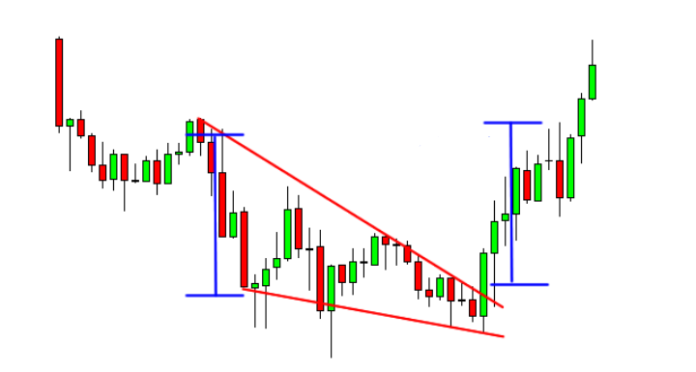

This positive inclination is a signal of an upcoming bearish trend. One must understand that this rising wedge is indicated when the resultant angle points upwards. It is plotted by drawing two lines, one joining the highs and the other joining the lows, creating an angle when they meet. The rising wedge is a bearish pattern and follows the major bearish trend, while the descending triangle is a bullish pattern.īefore understanding the significance of a rising wedge pattern, one should know how it is plotted on a commodity price chart.The Ascending triangle has a flat top with higher lows or a rising trendline, while the rising wedge doesn’t have a flat top.Whether you’re a day trader looking for short-term gains or a long-term investor seeking to optimize your entry points, understanding patterns can greatly enhance your timing and increase your chances of success. The importance of trading patterns lies in their ability to provide traders with entry and exit signals, enabling them to time their trades effectively. By recognizing and analyzing these patterns, traders gain an edge, enabling them to make more informed and profitable decisions. These patterns have been observed throughout history and provide valuable insights into the psychology of market participants. Trading patterns provide a window into the market’s behavior, allowing traders to identify recurring price formations and market trends. Ascending Triangle and Rising Wedge Winning Rate Case Study.The Advantages and Drawbacks of Ascending Triangle.In order to avoid false breakouts, you should wait for a candle to close below the bottom trend line before entering. Once you have identified the rising wedge (whether in a uptrend or downtrend), one method you can use to enter the market with is to place a sell order (short entry) on the break of the bottom side of the wedge. The charts below show an example of a rising wedge pattern in a downtrend: It indicates the continuation of the downtrend and, again, this means that you can look for potential selling opportunities. As in the case of a rising wedge in a uptrend, it is characterised by shrinking prices that are confined within two lines coming together to form a pattern. Identifying the rising wedge pattern in an downtrendĪ rising wedge in a downtrend is a temporary price movement in the opposite direction (market retracement). This means that you can look for potential selling opportunities. This indicates a slowing of momentum and it usually precedes a reversal to the downside. The price is confined within two lines which get closer together to create a pattern. As the chart below shows, this is identified by a contracting range in prices.

Identifying the rising wedge pattern in an uptrendĪ rising wedge in an uptrend is considered a reversal pattern that occurs when the price is making higher highs and higher lows.

Rising wedge pattern in uptrend how to#

This lesson shows you how to identify the rising wedge pattern and how you can use it to look for possible selling opportunities. There are two types of wedge pattern: the rising (or ascending) wedge and the falling (or descending wedge).

The wedge pattern can be used as either a continuation or reversal pattern, depending on where it is found on a price chart.

0 kommentar(er)

0 kommentar(er)